5.1. The framework for the analysis

Due to the general lack of (reliable) data on the future prospects of mobile search evolution, a Delphi-type survey was carried out with some of the main experts in the domain. The first round of the survey was done using an online questionnaire in March 2009, and the second and final round took place in a face-to-face workshop in April 2009 (see Annex I for more details about the questionnaire and Annex II for the workshop).

The objective of the questionnaire was threefold: first, to ease forward thinking and reflection on current trends and developments; second, to stimulate debate during the validation workshop associated to the project; and finally, to harness experts’ opinion along the key dimensions of the study (technological evolution, emergence of innovative business models and user acceptance) so as to cover the main issues that affects mobile search future development, its understanding and its drivers and barriers.

The questionnaire was based on distinct scenarios to contrast possible mobile search futures and to simulate possible uses and applications. The classical approach (Schoemaker, 1995) was followed to select them, and in particular, the two main dimensions of uncertainty in mobile search: the intensity of use of personal data in the application and the techno-economic developments required. The latter represents the techology push of an emerging domain and the former is arguably the summary of the users’ balance between usefulness and perceived risks.

Seven scenarios were finally retained for a forward-looking exercise with experts in the field. They are summarized in the Table 11 with their main characteristics and depicted in Figure 28 along the two dimensions mentioned. These seven scenarios were designed in such a way as to cover all of the technological and socio-economic relevant aspects discussed in previous sections of this report. From a technological point of view they cover the conventional (but highly relevant) search paradigm plus the most important trends likely to boost mobile search (see Section 4.1), namely context-aware applications, the internet of things and emerging cognitive technologies. They are reviewed in the next paragraph following this “roadmap” order.

The “dating agency” scenario (#7) deals with trust issues and the possibility of a third party handling them. It is one of the most obvious niche extensions of search into the mobile domain, where geo-location and personal profile are used to improve the usefulness of search. The “Playground mates” scenario (#6) is proposed to understand the social and economic limits of mobile search. In this scenario parents subscribe to a search application for the welfare of their offspring. The “wellness” scenario (#3) is a health-based scenario that takes into account the difficulties in aligning the diversity of interests of stakeholders, including users. Focusing on health data is a way to explore both possible business models and privacy implications. In the “Serendipity mode” scenario (#1), users activate a “discovery” function whereby unexpected but relevant information is pushed to them as a prime example of techno-economic driven evolution. It is also one of the most obvious applications of mobile search: context information. “Recipe search” (#2) is a scenario demanding a complex business model with very accurate information and a very high level of standardisation and interoperability. As another typical potential application of mobile search it uses the idea of “reality mining” where information is searched from physical objects. The “tourist mode” scenario (#5) is an application based on tagged content within a networked sensor infrastructure. It uses the concept of “augmented reality” to provide an improved user experience in another obvious setting: tourism. Finally, “the Truman Show” (#4) is a “black” scenario exploring the limits of privacy and commercialisation in mobile search. It uses the “big brother” concept through a mobile device where the viewers have full control. The detailed descriptions of the scenarios (#1 to #7) could be found in Annex I.

Table 11 places the seven scenarios with respect to these four dimensions. It gives also an overview of some critical elements in terms of technologies, user’s adoption and business.

As stated before, Figure 28 positions the scenarios with respect to the intensity of use of personal data (whose misuse is a proxy for potential privacy concerns) and embedded technological complexity, a proxy for technological maturity.

Based on the scenarios presented in the previous section, a questionnaire was distributed to 240 experts in the mobile and search fields. The number of respondents for this first round was 61. For the second round, 23 of these experts were gathered in a workshop to discuss the results and modify them accordingly.

Table 11. Main characteristics of the prospective scenarios

Figure 28. Scenarios: positioning with regard to their technological complexity and use of personal data

The profiles of the respondents show a reasonable balance. Finally, there were 442 valid responses across the seven scenarios. Industry (205) and academia (184) were equally represented, while 53 responses were from experts engaged in legal aspects and in research and development promotion from public administration. Years of expertise were similarly spread, with 180 responses from experts’ with less than 5 years of experience in the domain, 140 from 5 to 10 years, and 122 answers from experts with more than 10 years of experience. Regarding the main area of experience, 41 experts mentioned business and market, compared to 37 with user experience, 28 in technology development and 12 in legal affairs.

5.2. Main results of the experts’ survey and discussion

The results emerging from the first round of (answers to) the questionnaire are presented in detail in Annex I. The following sections of report summarise the main findings and the agreements reached during the face-to-face workshop.

5.2.1. Time horizon

The first analysis of the survey referred to the timeline along which the different scenarios are expected to be feasible from a technological point of view and when they will be adopted in the market. The objective was not to define an exact roadmap, but rather to gather expert forecast about the potential stopovers on the route of development of the mobile search environment, as depicted in the seven scenarios. Two questions were used across the seven scenarios:

- When will the underlying technology be available?

Figure 29. Scenarios: technological availability and time-to-market

Figure 29 shows the distribution of answers. Experts consider that –in most cases– the technology is either available (2009) or will be available soon (2011 to 2015) except for effective audiovisual search (“tourist”), integration with other services (“wellness”), semantic search and deployment of sensors (“recipe”), and cognitive technologies (“Truman show”). We conclude that technology is not the (major) barrier for the deployment of the mobile search applications depicted in the scenarios. Note also that experts confirmed that technology is expected to come ahead of the market. A time lag is expected between the actual possibility of having a scenario enabled from a technological perspective and its reach to the mass market. This time lag is bigger in more complex scenarios where aligning the interests of many stakeholders like scenarios 2 (“recipe”) and 3 (“wellness”) is key.

Ordering the scenarios, it could be interpreted that a shorter time to market is more likely to occur first in the take-up of conventional search adapted to the mobile environment in niche markets (scenario 7), followed by applications making a more intensive use of personal and social data to improve user experience (scenarios 1, 3, and 5) in increasingly wider markets. Scenarios requiring more complex services (like scenario 2) will arrive last given the effort needed for the integration of technologies, the interoperability of content and applications, and advanced interconnected services. The experts considered the “black” scenario (#4) not likely to occur, thus, placing it long away in the future.

As a whole most experts seem to consider all scenarios likely to happen in the next 10-15 years.

5.2.2. Major bottlenecks

Experts were also asked about the type of bottlenecks that could hinder the success of mobile search applications as envisaged in the scenarios. Figure 30 illustrates the questionnaire results.

In accordance with the previous sub-section, technology is not considered the most relevant limiting factor; Figure 30 indicates that economic and behavioural aspects are regarded more important.

Figure 30. Technological, economic and behavioural bottlenecks

Further, it appears that scenarios can be grouped into three different clusters:

- A first group where technology is not so important, economics are important, but behavioural aspects are extremely important (“wellness”, “playground”, “dating”, “Truman show”). These scenarios make intensive use of very personal data.

- A second one, where both the economic and the behavioural aspects are important with regard to relatively unimportant technology aspects (“serendipity”). A balance between use of personal data and business model is required.

Finally, those scenarios where economics are more important than the relatively less important technological and behavioural aspects (“recipe”, “tourist”). They require finding out a suitable business model to be successfully deployed.

5.2.3. Business models

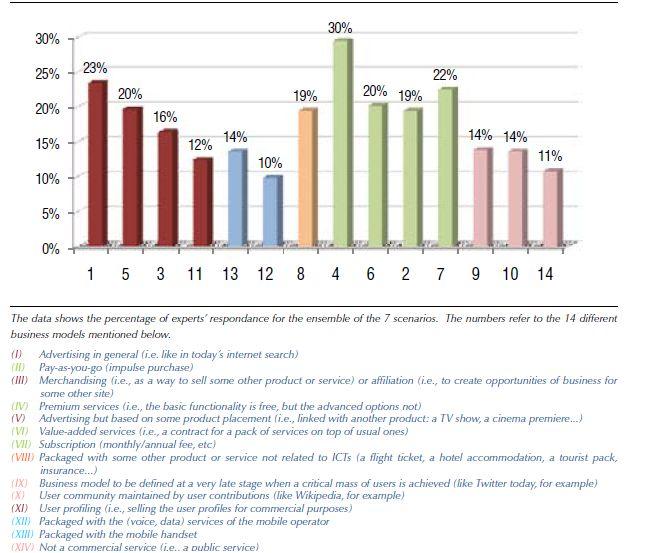

To examine techno-economic aspects, the experts were also asked to choose up to four business models as suitable for each scenario.22 The questions introduced the business models already summarised in previous sections. The overall results of experts’ responses are shown in Figure 31 with relative percentages.

The first four columns (I, V, III, XI) are related to advertising (advertising similar to the web, advertising linked with some product placement, merchandising/affiliation and user profiling, respectively). They seem to confirm the hypothesis of advertising, in its multiple varieties, being a fundamental business models in mobile search.

A second group of business models (XIII, XII) are based on packaging mobile search with some other good or service (the mobile device, the voice or data services of the mobile operator and some other good or service which is non-ICT related, respectively). The experts’ consider packaging options (VIII) more likely than traditional “walled garden” approach. Here, they consider mobile search as a tool within a number of products or services not related to communication as such.

The third block of business models (IV, VI, II, VII) considers mobile search as a premium service, as a value added service, as an impulse purchase or as a subscription service. Although seldom present in current mobile search market, this is mobile operators role, for instance. Finally, the last column demonstrates that public provision of some type of mobile search, although a less prominent choice among experts is nevertheless a possibility to be considered.

Figure 31. Preferred mobile search business models

The survey responses show a rather consistent picture of the preferred business models. The “dating agency” scenario (#7), a case for an improved web search applied to the mobile environment, and the “tourist mode” (#5), the most obvious example of mobile search utility, are prototypical of the average result. Premium services were considered the business model with a higher potential, but it was very closely followed by pay-as-you-go and packaged with a non-ICT service models. Advertising has a secondary role in both cases. Both of them probably show one of the most evident ways forward for mobile search.

A similar result was obtained for the “wellness” (#3) scenario, where subscription service now dominates. From the report perspective, this block of results contributes to the possibility of building appealing applications for niche markets. In this last scenario, packaging the mobile search application is preferred to advertising as a secondary option, in the report opinion an indication of a potential

preference for a third party streamlining the difficulties in the provision of complex services and managing it satisfactorily. Reading the result somewhat openly, it could be interpreted as mobile operator and device suppliers as the only players able to contribute to the provision of a value added service when there are many different (commercial) interests at stake.

For the “serendipity mode” scenario (#1) experts prefer conventional advertising as the leading business model. They also considered the possibility of “push advertising” and user profiling.

This scenario seems to underline that the range of advertising schemes are larger in the mobile domain increases than its web counterpart. Again, experts see a role for mobile device suppliers and mobile operators as providers of the service. In this scenario it is worth mentioning the relevance given to the “undefined” type of business model just looking for a critical mass of users. This could suggest the emergence of new de-facto standards related with the mobile search applications domain. “Recipe search” (#2) adds to the increased scope of advertising models in the mobile domain and interestingly also includes the “impulse purchase” model due, probably, to its relationship with a very demanding situation, therefore, a prototypical case of the aforementioned connection of mobile search application with the particular circumstances of usage.

In the “playground mates” (#6), a grey scenario in which children and parents are the protagonists, the highest ranked business model was the user community, followed at a distance by subscription and premium services. This scenario also has a high profile for the public provision of this type of mobile search. In our view, both results (user community and public provision) could be interpreted as some of the niches in mobile search domain sharing some public goods characteristics and therefore they are regarded as non-profitable from a private company perspective. As a consequence, there is, therefore, some role for public administrations in their provision. Finally, the “Truman Show” (#4) as a “black” scenario that should be avoided, highlights the dangers of over-exposure to commercial interests, and the experts have noted the potential connection with the type of advertising-related business models.

In this section, the key enablers, drivers, barriers and potentially disruptive trends in the future evolution of mobile search are briefly presented and discussed. The section is a summary of the main ideas discussed through the document and it is also an overview of the discussion with the experts during the workshop conducted in April 2009 in Seville (see Annex II for details).

5.3.1. Key enablers for mobile search adoption

Enablers are necessary but not sufficient conditions for a successful development of mobile search. They belong fundamentally to three types: those related to the availability of technical infrastructure, those linked with the framework of viable business models and those based on the perception of the user about mobile applications.

On the technical side, enablers are related to the availability of new devices and technologies based on them: interfaces like touch screens, 3D, or the capability of devices to capture information from sensors, about the environment and the person. From a mobile point of view, next generation mobile networks, 4G-type and beyond, are arguably the most relevant enabler of mobile search. 3.5 G technologies are enablers to improve download and upload speeds as well as latency to enable an adequate experience for users. Mobile networks shall be complemented increasingly by other types of wireless networks such as near field communications for interaction with sensors. In particular, the success of an open and interoperable Internet of things is a main enabler of context-aware mobile applications like mobile search. In addition, there are also technical enablers distributed across the mobile ecosystem:

the existence of open standards and solutions (the overall role of IMS being controversial), mobile

widgets, mobile “glue” technologies (for instance, javascript enhancements), SIM/smart card web servers, APIs (GSMA, OpenAjax, Bondi, Gears,RCS…), browser plugins (MS Silverlight, Mozilla,W3C…), and social network APIs.

Two elements appear particularly important to the business environment. First the adaptation of advertising formats to the mobile environment, recognizing the fact that advertising is de-facto the only business model for web search and likely to play a dominant role in mobile search. Second the drive towards more personalised and contextaware applications, whereby mobile devices hold a unique competitive advantage.

As an overall enabler, advertising is shifting from mass advertising (television, newspapers etc), to a more targeted, personalised and engaged format. This benefits search in general (both web and mobile) at the expense of traditional media. Note, thus, that mobile advertising is scalable to the extent of a significant amount of substitution with traditional media, but –in order to become more effective– advertising needs to become platform specific (but globally harmonised like Nokia ad service, Android or iPhone), as opposed to current platform agnostic, and at the same time more granular.

The availability of information adapted to improve the mobile search experience is another main business framework element. Interoperable and standardized location information seems to be a necessary precondition, followed by a more ambitious similar initiative regarding contextbased information in general.

The creation and storage of digital content doubles roughly every three years. There is a proliferation of formats and a major shift of content from text-based information to multimedia. This abundance of digital content creates at least three major challenges. First, although crawlers are increasingly better performing to gather information on the web, the size of the hidden web remains immense and outside the reach of conventional searches engines. Specific for the mobile environment is that highly valuable information for realtime context-aware applications is located in proprietary databases. The success of these mobile search applications is based on the one hand on technological improvements to make use of data needed for context-aware applications and, on the other hand, to ensure that access to such data is available. The second challenge with regards to the abundance of content is how to structure and index increasing amount of “raw” audio-visual content with little or no metadata attached to it. This is a general issue for search engines; specific for mobiles is that the shift towards more audio visual retrieval poses far larger technological challenges for mobile devices than for PCs. Finally, a competitive advantage of search engines would be to filter, prepare and package content suitable for mobile applications, rather than only facilitating access to this content.

Social computing lends itself well to mobile search since it involves creating and organizing information which communities can do in a more extensive way. The difference with the fixed counterpart lies in the mobile device opening up the possibility of sharing 90% of the daily pattern, in comparison with a mere 10% in a fixed access web model.23 Finally, a positive perception about usefulness (value for users), ease of use and user in control will contribute to create the conditions for the success of context-aware mobile search as previously discussed based on the results of the experts’ survey.

5.3.2. Key drivers and barriers for mobile search adoption

Drivers are variables affecting future mobile search developments, supposing that required pre-existing conditions (enablers) are met. Barriers are factors impeding development in the short term or, more worryingly, in the medium to long term. Drivers and barriers are obviously related and, in this section, they are going to be jointly introduced and discussed.

From a techno-economic perspective, the one driver that matters most is the availability of context-based metadata-enabled content. The use of context will make the difference in mobile search. Without it, it will be highly unlikely to be able to provide a differential value to users of mobile search as compared with conventional search. The success of the internet of things and its usability and interoperability are the base of the context-awareness as mentioned previously.

Related to metadata enabled content is the users’ involvement in the creation of tagged mobile user generated content. Here the role of reputation dynamics and the potential of the mobile as a unique device that can automatically add relevant data to content captured on the phone (i.e., metadata enabled content captured from mobile devices at the point of inspiration, for instance geo-tagging images) are particularly relevant. Regarding reputation, the more content volume increases and more people go online from a mobile device, the more there will be a drive for seeking out content which is relevant and has been provided by ‘trusted sources’. Therefore, mobile search will be tied to reputation and trust. In this regard, algorithms, engines and tools for user-in-control are still needed to associate trust and reputation to content in a mobile environment. Search applied to citizen journalism, where users collect, report and distribute information about events, is arguably a major example of this necessity. With respect to tagging, the recent example (it was made available during the summer of 2009) of Twitter including geo-information is very relevant. Users of this service not only can search the information posted by their network of contacts but simply that “tweet” which is related to a location. Note that using the mobile device as a camera is the most common form of content capture, followed closely by video clips recording (Ofcom, 2008). As another example of automatic tagging, digital mobile footprints, where the user’s position in time and space and activities are exposed, bring a new dimension to social computing. In fact, knowing when your friends are around and meeting people sharing the same interests is expected to drive the adoption by users of mobile social computing. The capabilities of mobile devices as environment sensors add to these digital footprints and make possible the contribution of users to “reality mining” where all types of information are placed on top of physical entities. Therefore, as a summary of these drivers, social search and realtime augmented reality search are the two other elements that complement context and create the distinctive user experience in mobile search.

In connection with the preceding driver, there is an increasing consensus that such a complex ecosystem for mobile search (and other types of mobile applications) can only be tackled with some degree of cooperation among players and openness in the platforms they use. This process can take shape in many different forms and several main players are exploring such possibilities. Google’s Android is maybe the most paradigmatic example of creating an open platform to develop any kind of application. However note that even such an open approach requires both the collaboration of device suppliers (for the fabrication of the hardware) and mobile operators (approval and subsidisation of the device). On the other end, Apple’s “app store” creates a “closed” environment where all the interested parties can work with a high level of certainty. It could be said that the heterogeneity of the ecosystem and the same “long tail” effect that attracts innovation (see below) are responsible for the difficulties in achieving the appropriate economies of scale that render investments profitable.

The main driver on the user-demand side is linked to the new perception of users of the usefulness of social, real-time mobile applications Online stores offering mobile-tailored content following the long-tail business model will increase the opportunities to innovate, create niche markets (many types of mobile enterprise search-related applications are possible, for example) and, in general, monetise on-the-go consumption. As a consequence, it is likely that business will evolve around value-added services supplied through mobile search applications that the user has previously downloaded. The possible list of mobile search applications is endless: search within a specific domain of information (tourist, travel, work, navigation…) sometimes also named vertical search; context-aware search– discovery mode where the user only sets some preferences and receives relevant information

in an appropriate time and situation; real-time search - where the immediacy of information

is the relevant parameter; multimedia searchor audiovisual search; search for an object or

physical parameter (internet of things); on-device search combined with conventional search;

mobile social computing search; etc.

Summarizing the business perspective on mobile search, the big providers of internet search and social applications (Google, Yahoo!, Facebook, Twitter, etc) are trying to shape mobile search as an extension of their current activities. The extent to which this will happen is not obvious. The authors of the report believe that mobile search has many distinctive features that might allow for new innovative players to gain market share and become influential. This is also creating new partnerships that will aim at mobile search applications in some way. There are many examples of new alliances: content providers who become API enabled (like the Guardian newspaper in the UK), deeper integration between the network, device and the service (Nokia N97 – Skype phone), partnerships between non phone players like Amazon Kindle with network and content providers, new players who manage internet of things (no main examples yet as of time of writing), content players with devices including content stored in extended memory cards (like Sandisk), social networks and devices partnerships (INQ1 phone with Facebook and Operator 3 in the UK), and, last but not least, device stack consolidation (LIMO, Android) which unify the device software platform and lead to a simpler and standardised access to APIs.

For the user, privacy and management of mobile digital identity can be both a driver and a barrier. In order to enjoy mobile search personalised services, the user will have to reveal some personal information to players across the mobile ecosystem. To many observers the success of advanced mobile search applications will require a higher degree of acceptance of profiling and behavioural tracking as we are currently accustomed As a consequence, the different approaches to privacy (privacy by design, privacy by law, etc.) will have a critical impact on the evolution of mobile search.

In particular, looking at the regulatory part, this will define the potential of the framework for mobile search applications. Note that there have been already a number of complaints both in the EU and USA about abuses in mobile marketing. As a summary, although personalisation can create better mobile search services, there is an increasing concern as more data is available both in the public domain and in the hands of private players. A privacy backlash could deeply affect further developments in advanced mobile search.

A final driver/barrier is the user’s latent (e.g. non-expressed) request for content discovery and learning, which goes beyond just wanting to be entertained. This poses a challenge for the design of mobile search applications, since results (and applications) need to embed a “surprise” factor while being useful and usable at the same time. Such application must have a minimum level of “quality” to be adopted by potentially interested consumers. Also the search process will be “hidden” from the user in many of these applications or reversed (from existing reallife content the source of original or additional information is supplied). In the authors’ view, the aforementioned issues are signs of a larger trend to shift from mere “search engines” to “recommendation engines”, able to include in real time the user’s preferences, social network and contextual information in the search results.

5.3.3. Disruptive trends

A foresight exercise on disruptive trends likely to affect the sector was also conducted. The aim was to identify disruptive trends in the mobile search domain. Eleven clusters of technologies were identified likely to influence the mobile search market of the future: 1) 4G and beyond mobile communications, 2) the ensemble of cognitive technologies, 3) artificial intelligence, 4) the internet of things (objectbased networks on RFID or other equivalent technologies), 5) new user interfaces (touchbased screens, natural language interfaces, etc), 6) location awareness of presence (satellite or wireless sensor based), 7) semantically structured information and knowledge, 8) cloud computing, 9) augmented reality (including technologies for perceived immersiveness, like 3D), 10) peer-topeer networks and applications, and 11) mesh networks.

The technology clusters were analysed from the point of view of impact for the mobile search area. The results of the survey were discussed by the expert group. Given the maturity of the clusters vary to a large extend, there was a need to order also the impact of the technologies with their emergence on the market. This is particularly an issue for those technologies that build upon each other and whose deployment triggers the development of other technologies. Figure 32 plots the eleven clusters of technologies with regards to their timeframe and potential to disrupt the market. The time relevant for this analysis is the moment when they are mature enough to impact mobile search.

The circles show the relative position of technologies as perceived by the experts. The numbers refer to the following list: 1. 4G and beyond mobile communications, 2. Cognitive technologies, 3. Artificial intelligence, 4. Internet of things, 5. New user interfaces, 6. Location awareness of presence, 7. Semantic structured knowledge, 8. Cloud computing, 9. Augmented reality – 3D, 10. P2P, 11. Mesh networks).

Figure 32. Domains of technologies of relevance for mobile search by their importance and likelihood to appear in the market

The impacts of these technological trends have already been discussed throughout the report. Here they have been complemented by cloud computing and P2P because they have relevant implications in other public policy domains.

Cloud computing can represent a driver for the search engine world. However, a visible is the lack of standards and interoperability, implying that data portability will be the great challenge for searching in the cloud (for instance, portability of geo-coded information). Public procurement has been mentioned as a possible lever to foster data portability and the promotion of standards. Further, data portability is identified as a guarantee for user autonomy and freedom from lock-in effects. The experts promoted the idea of fostering discussion among interested actors (industry, governments and users) on data portability issues.

With respect to P2P, the experts agreed that the current regulatory framework for digital rights management is representing a barrier for the exploration of the potential of P2P search. P2P search in the mobile domain is connected with mesh networks and, therefore, requires some new methods for dynamic spectrum allocation. This fully falls in the category of potential policy interventions. |