Understanding adoption behaviour of mobile search seems to be largely overlooked in literature as our review on relevant studies on the use of mobile device functionalities and services illustrates. A recent benchmark exercise by ComScore includes ten different mobile internet activities but none of the indicators takes mobile search into account (ComScore M:Metrics, 2008b). A report by Morgan Stanley from 2008 on iPhone usage illustrates the frequency of usage for sixteen mobile service functions but again excludes mobile search (Pascu, 2008a). Another survey carried out in Finland during fall of 2007 with 579 panellists measured the intentions and usage related to seventeen mobile services. Again none explicitly measured mobile search (Verkasalo, 2008). Another indication that this area is at its infancy is illustrated by the conclusions of a literature review of “mobile commerce” from 2007: mobile commerce refers to any transaction through a mobile network that has monetary value; however, the authors’ categorisation did not include mobile search (Ngai and Gunasekaran, 2007).

Fortunately, a few interesting studies on mobile search use do exist. Moreover, mobile search is not a service created from scratch. Therefore, common factors impacting adoption and use of mobile internet services relate also to the area of mobile search. For this reason we will describe adoption and use of mobile internet services first from a general point of view.

Similar to other advanced ICTs, the adoption of mobile services is likely to follow some basic factors acting as drivers or barriers for acceptance and use. Here, the technology-acceptance model (TAM) is one established method to analyse the deployment such new technologies. The TAM concept makes use of variables like the perceived usefulness, the perceived ease-of-use and attitude towards use. Examples such a methodological approach include a studies of mobile services in general (Pedersen and Thorbjørnsen 2003); of mobile internet business use (Pedersen 2005); of using mobile calendars (Sell and Walden, 2006); and of mobile news services (Westlund, 2008b).

A critical question is whether there is a real consumer demand for mobile search or not. Haddon and Vincent (2008) have conducted focus groups with 11-16 years old children in the United Kingdom. The following quote is extracted from a discussion with a group of 11 to 12 year olds on what kind of mobile internet services they wish to use (Haddon and Vincent, 2008:16):

Annabel: My friend, she forgot her homework. So she looked something up in Google on her phone and wrote the definition down.

Alicia: Wow. Oh, I want Google (…) I’d do my homework on the way to school.

Is mobile search generally as appealing for everybody as it is for Alicia? A European study conducted in late 2005 revealed that 6% of mobile users actively use mobile search (Church et al., 2007). More recently, ComScore M:Metrics (2008a) measured how many mobile users used their mobile device for search in France, Germany, Italy, Spain, the United Kingdom and the USA. They recorded the average number of users in April, May and June, comparing the years 2007 and 2008. In 2008, there were 20.8 million mobile search users in the United States (9.2%) and 4.5 million in the five listed European countries (5.6%). This represents an increase of 68% and 38% from June 2007, respectively. The United Kingdom showed the highest penetration rate followed by the USA and the other European countries. In addition to the rise in mobile search users, the report shows also that also the frequency of activity is growing as high as close 50% in the all countries. Analysts at ComScore explain this by an expanded 3G penetration, an increased adoption of advanced mobile devices, better offerings of mobile search services and flat-rate data plans. At the time, Google had the highest mobile searcher penetration (60%) in all of these countries, while Yahoo and MSN/ Windows Live Search (now Bing) alternated in the second position.

Pascu (2008b) discusses two additional M:Metrics studies. The first study, carried out in the USA in January 2008, shows that 58.6% of American iPhone owners used the mobile search function, compared with 37% among other smartphone users and 4.6% for the entire mobile market. The second study in a European context (France, Germany and the United Kingdom) from July 2008 illustrates that mobile search is even more popular among iPhone users from these countries (more than 80%). Meanwhile the amount of other smartphones users who access the mobile search function (32%) is less than in the USA and the total market is at an equivalent level.

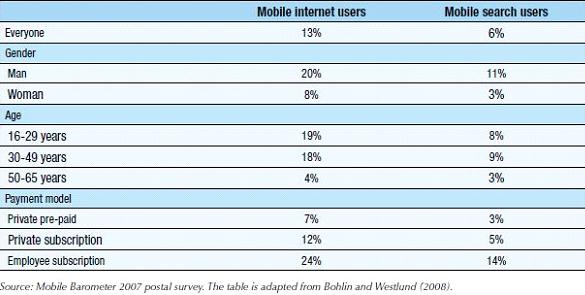

The most detailed studies are probably those carried out in Sweden and in Japan. Both nations have a high general adoption of ICTs, being Japan the higher of the two. In Sweden, a representative survey –called the Mobile Barometer– was carried out during the fall of 2007 and reports the usage of a number of mobile services (Bohlin and Westlund, 2008). The results illustrate that 13% of Swedes aged 16-65 used mobile internet on a monthly basis; of which half of them used search engines. The survey further illustrates a gender imbalance; men using mobile search more frequently than women. There is a gap between users aged 16-49 on the one hand and those aged 50-65. Among the 16-49 year group, about one in five use internet services on a monthly basis. The number is close to one in ten for mobile search, witnessing about a similar gap in usage compared to people aged 50-65 years. Table 6 reveals that there are significant differences in usage between different user groups, depending on which payment model. While pre-paid cards owners use mobile internet and mobile search the least, it is slightly more common among privatebased subscribers, and especially among people with business subscription. The study shows also correlation of increased usage with high income, as well as among 3G-users with expressed interest in technology.

The Swedish Mobile Barometer survey included a potential demand analysis. About one in four said not having used mobile search at the moment, but potentially doing so in the future. Although this means that there seems to be a consumer demand for mobile search, 56% said they have no interest in using such a service in the future at all (Bohlin et al., 2007). Also in Sweden,

Table 6. Usage of mobile internet and mobile search in Sweden (2007).

Karlsson (2008) conducted a web survey of 925 Swedes, based on a non-representative sample. The respondents were mostly early-adopters since 94% expressed that they had access to the mobile internet, amongst which 96% used it sometimes and 41% use it on a daily basis. An interesting results is type of services used by early-adopters: news accessed through a mobile website ranked as the most common service (82% of the respondents), followed by mobile search, with 64%.

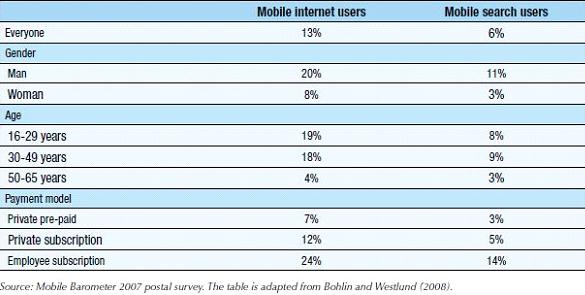

In Japan, the research company Myvoice analysed mobile use through an internet survey of 19,602 internet users aged 10-59 in November 2007. 9% of the respondents said that they use "often" mobile search (Myvoice, 2009). Also in Japan, Mobile Society Research Institute at NTT DoCoMo performed yearly surveys (2005 to 2007) including question on future mobile search services. The survey question was: "Which contents do you want to use on your cellular phone including those you use now?" Table 7 shows that the responses were relatively stable over the years: about one in five Japanese said that they use or want to use their mobile for search activities.

The most demanded activity is seeking for information about bus and train schedules, while searching information related to health is less common. Unfortunately, it is not possible to determine how the actual usage has changed over the years, in relation to the perceived demand for such services. The NTT DoCoMo survey analysed the demand for mobile search by gender and age groups. During 2005 and 2006, females used the mobile search functionality more than men, but in 2007 differences were practically non-existent. There are, however, significant differences between age cohorts: 36% among people aged 15-19 expressed a demand for mobile search in 2007, compared to 18-21% among people aged 30-49.

Table 7. Demand for mobile search functionalities in Japan (2005 – 2008).

A common approach to carry out studies on mobile search usage patterns is to analyse largescale logs of mobile searchers behaviour, based on the search engine databases. This method reveals what people do, but does not allow to cross-check with users demographics or user’s experience (such as the context or inspiration of the search activity).

In two subsequent studies, Kamvar and Baluja (2006, 2007) provided insights into Americans mobile search behaviour based on large-scale logs analyses of a Google database. The 2006 study, for example, analysed more than one million page view requests. Baeza-Yates et al. (2007) analysed the characteristics of mobile search queries submitted to Yahoo in Japan, comparing one million mobile search queries with a set of one hundred thousand desktop search queries. While the aforementioned studies focused on mobile search behaviour with one specific search engine, Church et al. (2007) in their analysis (European countries, from late 2005) used a data set consisting of data from 30 search engines. The analysis was based on 600,000 European mobile subscribers, among which approximately 50,000 were mobile searchers, generating more than 30 million mobile internet requests. In their subsequent study of European mobile subscribers, Church et al. (2008) carried out an exhaustive analysis of European mobile subscribers’ use of mobile search engines. The data was based on 2.6 million subscribers, among which 260,000 had carried out at least one search request, generating a total of about 6 million mobile searches.

There are methodological difficulties comparing above studies, although at a first glance they may seem to be similar to each other (for a general discussion we refer to Livingstone, 2003, and Haddon, 2005). Despite differences in terms of place, time, database size and number of search engines analysed, we can come to some general conclusions regarding mobile search usage activities and patterns. Studies on mobile search usage activities through large-scale logs analyses suggests a discussion along the following three themes: 1) search input and scope; 2) search topics; and 3) interaction with results.

Church et al. (2008) detect that the length of queries contains circa 2.2 terms or 13.4 characters on average. These numbers are rather consistent with previous studies. Kamvar and Baluja (2007) report that the average mobile query was 2.56 words and 16.8 characters, and that it takes the average user about 40 seconds typing their query. Compared previous years users now type faster; they also click more often on links while exploring in their sessions (Kamvar and Baluja, 2006). A similar study in Japan (Baeza-Yates et al., 2007) illustrates a close correspondence between the number of terms in mobile queries (2.29 terms per query, on average) compared to desktop queries (2.25 terms per query). The authors observe that the mean number of characters used for mobile queries is 7.9,7 notably shorter than the 9.6 used for desktop queries, motivated by the fact that it is more difficult to type with a mobile device.

Regarding on how queries are performed, Church et al. (2007) realised that 23% of the queries (averaging 2.1 terms per query) were modifications of previous queries, i.e. most commonly simple substitutions of terms. In their subsequent study, Church et al. (2008) found that it had become more common for searchers to modify their searches, making it more appropriate to refer to these as “search sessions”. An average such search session accounted for 8.6 queries, up from 5.8 queries in the previous study. Another finding is that users increasingly have difficulties to locate the information they were searching for. The authors found that mobile searchers repeated identical queries (73%). The reason is possibly that –given the limited screen space to list the results– mobile internet make additional search requests to receive a similar number of results as the searcher of the desktop internet. In comparison with their previous study, the number of identical queries had increased, indicating that mobile searchers are less successful in finding what they are looking for.

The research on mobile search activities involves two aspects, firstly what type of search topics users are directed towards, and secondly a taxonomy of mobile search behaviour intentions.

In Japan, the most popular mobile search queries are related to online shopping, sports and health (Baeza-Yates et al., 2007). In Europe and US, mobile search topics follow a different ranking: the most popular search category is adult content. Kamvar and Baluja (2006, 2007) find that besides adult material, the search topics of entertainment, internet and telecom and local services are the most popular. Church et al. (2007) report that 53% of the top-500 queries were adult-related, while multimedia was the second most popular, accounting for about 10%. In their subsequent study, Church et al. (2008) show that adult-related content accounts for about 60% of the top 500 mobile search queries. The rise in popularity of adult content is at the expense of searches for entertainment, multimedia, and games.

Kamvar and Baluja (2007) discuss two hypotheses about the high percentage of adult mobile search queries. Adult category used to be very prominent in early web history, until it declined in popularity. The first hypothesis is that mobile search will follow a similar decline the more it develops and attracts more users. This argument has also been suggested by Church et al. (2007). The second hypothesis is that people feel more comfortable querying adult terms on the mobile than on the web. It is perceived as a private device immune to strangers prying into digital history marks such as URL history lists and cached pages.

Regarding the search topics, there has been a discussion in literature whether usage patterns are becoming more or less homogeneous. On one side, Kamvar and Baluja (2006) reported that the most popular query accounted for 1.2%, while the top 1000 queries accounted for 22%. In their subsequent study from 2007 they found that the top query accounted for 0.6% and the top 1000 queries for 17%. Thus, mobile search query usage patterns would become less homogeneous. On the contrary, although their study is not fully comparable with Kamvar and Baluja (2006) since they analyse the top 500 queries instead of the top 1000 queries, Church et al. (2008) indicate that search queries are becoming more homogeneous. They find out that the most popular query accounts for 2% of all queries, and the top 500 queries account for a stunning 26% of all queries.

The second aspect of search topics regards the taxonomy of mobile search behaviour intentions. According to Church et al. (2008)’s taxonomy, mobile search queries can be categorized into three categories: navigational, informational, and transactional. Navigational queries (10.2%) refer to a class of queries where the immediate intent is to reach a particular site, such as domain suffixes or company names.10 Informational queries (29.4%) involve situations in which users attempt to find information online but no further interaction is expected. The most used category by far is transactional queries (60.4%), i.e. whenever the user seeks for further interactions such as shopping, gaming, downloading files (images, videos, music, etc.). This category also includes adult-related queries (Church et al., 2008).

Church and Smyth (2007a) carried out a complementary study of mobile search intentions and needs from a different perspective and with another methodology than the studies discussed so far. During four consecutive weeks in late 2007, they followed a diary study approach with twenty participants having a mean age of 31 years. Their most important finding is that mobile searchers consider the context valuable for their information needs, especially with regard to location and time. When it comes to location, it is evident that people want to search for services/ products that are geographically located close to where they live or work. Regarding temporal dependencies, people express information needs including temporal cues.

There is only one study of how users interact with the search results they gain, giving insight into the perceived relevance of search results and the extent to which search engines deliver good results tosearchers.This study has been carriedout by Church et al. (2008) and is based on a Google database (accounting for 85% of the search activities among users). Assuming that interactivity (number of clicks) with the displayed results is an indicator for relevance (the more clicks the higher the relevance), they recorded the number of clicks. Within one search session, about four out of ten searches lead to the selection of one of the search results. Assuming that click-through is a measure of success of search results, it can be concluded that most result-lists failed to attract searchers’ attention. An alternative explanation is that users were already satisfied by reading the result snippet. They question this argument since only three out of ten searches were navigational, and the results indeed illustrate that the usefulness of current mobile search engines is limited. One reason they give is the limited level of usability: many mobile devices had weak interaction capabilities (especially at the time of the study). Having analysed that, assessing the real significance of these figures would have required to compare the results with those obtained repeating the search experience on a PC.

Thirty years ago it was considered that every media has its own unique logic and is specific. Thus, its functionality and services therefore must be developed having this logic in mind (Altheide and Snow, 1979). It is common that new technologies and media imitate its predecessors. An example from the news media industry shows that radio news imitated newspapers, TV-news imitated radio news, and internet-news imitated all the others. After some time new media forms were developed and found their own logic.

Feijóo et al. (2008) have proposed a classification of the mobile content space that follows the media logic theory. Their four categories are: a) adapted (already-existing content from other media); b) re-purposed (content reused and adapted); c) original (content specifically designed for mobiles); and d) augmented (content with mobile specific properties of increased value). Similar arguments have been brought forward by industry representatives. For example, Rick Hutton at Lycos Wireless motivate their choice of partner for mobile search as “because they focus on wireless infrastructure and search, rather than being internet focused, and take what they’ve done and make it conform to the wireless space” (Kennedy, 2009). Among initiatives taken by the industry, Microsoft and Yahoo have started to develop tools such as auto-completion, related queries and a voice-based user interface.

Mobile search engines can be improved in order to increase the demand by enhancing the mobile search user experience through more mobile specific developments. Church et al. (2005) showed that the search listings could well be accompanied by more informative related queries. A major advantage for the provision of mobile search is that related query terms only need a fraction of the screen space. Karlson et al. (2006) argues that text entry and search off the device could be altered for the search model applied to mobiles, which they consider too similar to web search. They suggest that mobile search should be used to explore search scenarios. Arter et al. (2007) explored opportunities for in-situ sharing of user’s mobile search activities, based on logged usage data in combination with interview and diary protocols. The idea is to present to a user in given geographical location, the search queries of other people at the same place. This approach might help users in finding non-obvious insights beyond results they intended to find. Church and Smyth (2008) proposed a context-sensitive mobile search; one that combines location, time, and community preferences where instead of requesting from users to formulate their own queries, they could use previous results and queries from an interactive map-based interface.

Given the lack of literature on qualitative explorations into the personal mindsets of users with regard to mobile search, we carried out a focus group study to investigate these matters. In March 2009, five focus groups with a variety of mobile users have been conducted in Gothenburg, Sweden.

The focus group method relies upon the assumption that a researcher is able to follow the mindsets of people on a specific topic by discussing with the respondents. This is a common method employed to investigate unexplored research topics using the interactions between the respondents in the group to facilitate a more initiated discussion. We followed a standard procedure for the method, using an interview manual with a set of themes to systematically explore the personal experiences and perceptions among the group members.

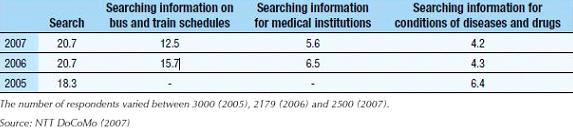

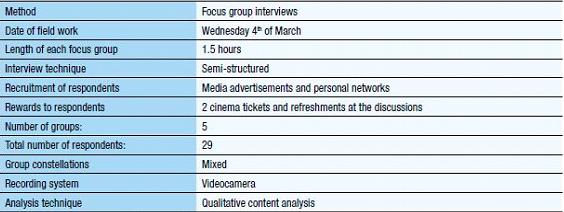

Table 8 describes the methodology followed for the focus group survey.

The focus group respondents were recruited through several communication channels of the regional newspaper Göteborgs-Posten. Advertising banners were placed on the front page of the news web site during 5 consecutive days (weekly reach; 350,000 unique visitors per week), as well as in the mobile specific website (80,000 unique page impressions per week). Personal encouragements to participate in the study were sent to subscribers of the newspaper’s SMS-based news service (subscriber base of more than 500 people), to the subscribers of the company’s newsletter (about 30,000 subscribers) and to the consumer panel (more than 1,000 people). Furthermore, one local high school arranged for students to participate during normal school hours. In addition, personal networks were activated to encourage users of mobile internet to participate.

Table 8. Focus group methodology

The initial intentions were to form specific groups with different types of experienced users, such as a group of touch-screen users and another of smartphone users. Meanwhile, due to difficulties in the recruitment process, mixed groups of respondents had to be compiled. These groups did, however, fulfil minimum standards in terms of profiles: ages from 17 to 54 years, 17 females and 12 males, employed and students, non-users and heavy users, etc.

Following standard methodological procedures, an interview manual with a set of themes was used to systematically explore the personal experiences and perceptions among the group members. The introductory theme covered the background of the respondents, and how they use their mobiles in their everyday life. It included an extensive discussion on their experiences of using the mobile for different types of internet related services. Non-users were naturally less active in discussions, but did nevertheless add value to it by expressing what types of internet services and content they would like to use with their mobiles. The following theme covered attitudes to adoption of mobile internet services in general, in order to foster a sound understanding of what factors are perceived as important by the respondents. The third theme elaborated more specifically on experiences and attitudes related to mobile search in particular.

From the themes of the focus groups, four sections of analysis have been derived: 1) mobile internet adoption factors, 2) mobile internet usage patterns, 3) exploring mobile search behavioural profiles, and 4) perceptions on the mobile search usage experience.

Another usability issue regards navigation: respondents find it more troublesome to navigate with a traditional mobile with a keypad than with a touch screen. Browsing internet sites is considered too slow; which is partly caused by the insufficient bandwidth of mobile internet networks, and partly by the limited processing power of mobile devices.

When it comes to cost there are basically two concerns at hand; firstly, people feel uncertain about the real costs of use, and secondly, they think that prices are too high. Regarding the uncertainty, people are largely unaware and find it difficult to determine the costs charged to access the internet. Some believed they are charged per minute; others thought by traffic. Both groups, however, were not aware how their usage would translate into costs. Those who checked their bills, come to the conclusion that using mobile internet for services that are predominantly text-based is not expensive, and will continue doing so. Concerning the overall costs, many are not willing to pay for mobile internet access at all, since they are already paying for internet access via their PC. Others would pay for access to the internet with the mobile but think that the present prices are too high. There is broad consensus that flat-rate is the best option, giving a sense of control and freedom. Anyhow current prices are not appealing. Ideally the flat-rate pricing to access the internet with their mobile should be roughly the same as domestic broadband via PC. Several said the service via domestic broadband is better, and that this gives them a higher user satisfaction.

Surprisingly, security, privacy and trust matters did not come to much at the fore during the focus groups discussion. People are largely unaware that mobile content providers might monitor usage to optimise a personalised proposition of services, for example for locationbased services. The respondents seem overall happy using the mobile for internet services and content in the current situation, possibly because their experience of personalised services is yet limited. Due to that, no respondent encountered any problem with regard to security or privacy. Only during the discussion they started thinking about the need to control privacy for personalised services and on how it would impact if personal information would be used to offer commercial value propositions.

People use their mobiles in diverse ways: some just as an interpersonal communication tool for voice calls and SMS; others more as a multimedia device (MP3-player, music exchanger, camera, etc). Only good data capabilities allow using mobiles to communicate through e-mail and social networking sites (such as Facebook). Indeed, many respondents are using these functionalities several times a day. Other prominent uses include visiting news sites and collecting information about public transport, recipes, weather, time and places. People say they use search functionality to access information relevant to their needs in particular situations.

People’s habits of accessing information through the mobile internet do vary. Some people start internet surfing from the telecom operator’s portal. Such portals usually contain a wide range of content, they are easily accessed and the headlines can be browsed free of charge making them "attractive to get into the internet". Other respondents are less enthusiastic; they find the content too limited and the advertising often irrelevant. Using bookmarks is commonplace, which helps users navigating directly to the websites the users are fond of. Users must, of course, have found the website for the bookmark in the first place. Usually they have done so by either inserting the entire web address manually, but more often by querying the web address through a search engine. Novice users first explore opportunities within the telecom provider’s portal, but soon move on to explore websites and internet content more independently through bookmarks and applications. Users of advanced mobile devices have also adopted more sophisticated applications. This behavioural pattern follows pretty much their experiences from the desktop internet.

Interestingly, respondents use their mobiles to connect to the internet not only on the move but also when at home, but there are differences. A novice user typically uses mobile internet while on the move only, i.e. when he/she cannot access the internet in any other way. More experienced users access the internet via mobiles also in those situations where they could use also the computer, i.e. when they just consider it a more convenient alternative. For instance, the mobile is the most accessible option to access the internet during a short commercial break on TV or while lying in bed.

Being in control of the information flow is perceived to be important. Most people stress that they prefer to use mobile internet on demand, when they really feel that they need it. When it comes to push-services, such as e-mail, news, SMS, etc., some users tend to ‘loose the feeling of control’. Others, on the contrary, have simply assumed the behaviour changes associated with constant accessibility. Lina (F,23) –for instance– says having intensified significantly her usage since she got her iPhone half year ago. She acknowledges that it is not socially correct to browse internet while being in company with others, but she cannot stop checking e-mails and updates on Facebook, and she tries to do so in discretion. While socialising with peers she has hidden her iPhone in a book or purse while using it for mobile internet. She argues that she finds it comforting to take a pause from her social environment and just focus on herself and her needs by using mobile internet. This is a way for her to create some personal space within the public domain.

It was argued that there is an interest in personalised and location-based services. Several users said they would be willing to register personal information if this enhances the information they can access. This includes the usage of geographical positioning, which they believe could be used for finding restaurants etc. in their vicinity. It is generally difficult for people to visualise how specific location-based services would fit their everyday life needs, but they this does not refrain form positive and negative reactions to such services. Anna (F,27) argues that any personalised services must be tailored to user’s needs: info of traffic jams is only relevant when she drives a car and on her way. Some are concerned of companies’ use of their personal data gathered by behaviour patterns to sell commercial services and express desire to be able to control this type of information. Some say getting personally offended if the information is too personal, as it affects their personal integrity.

Also noteworthy is that there were the occasional users, those having somewhat older mobile models with a more limited user interface, who did express large demand for more mobile specific services. Contrary, respondents accustomed to using the mobile for search more frequently with a touch screen device, do avoid more often using mobile specific sites. From their point of view, they become most satisfied when they can access the full version internet sites with their mobiles, as they are used to accessing them with their computers.

The focus group sessions uncovered a variety of user patterns related to mobile search. The members of the focus groups use differently their mobile device for search, depending on the type of device. Some use Google from its mobile website, whereas others access it as an integrated application with the mobile device.

Our observed patterns only partly be attributed to the three types of searches and integrated into the taxonomy proposed by Church et al. (2008): 1) navigational searches, 2) informational searches, and 3) transactional searches. To fit better our findings, the following four categories are proposed:

• Navigational searches. Similar to Church et al. (2008)

definition: the purpose is to reach a particular site, such as a company domain.

• Logistical information searches.

The aim is to search for information that solves a logistical problem. When on the go, people use the mobile to interrogate the timetable of trains or public transport. They also require geographical positioning through map services, such as finding directions or the address of a restaurant where they have an appointment. Local information can be implicit or explicit in geographical searches. Also browsing the website of the university department for updated information on lectures etc. would fall into this category.

• Transactional searches. Similar to Church et al. (2008)

definition: the user seeks for further interactions as in the case of shopping.

• Leisure searches.

Here, search is in the realm of spending or organizing private time, even to the extreme to enjoy the search process itself. Beyond searching at the specific occasions where they perceive it as necessary, users use it for fun or spend spare time, both on the go and at home. Typically users search for content such as lyrics, videos and images.

The data gathered from the focus groups indicate that every mobile search user occasionally carries out navigational, informational or logistical searches. In general, such searches are more often carried out while on the go, in situations when people do not have access to desktop internet. Magnus (M,43) values the freedom to access mobile internet information whenever needed. At the same time, he uses mobile search only if he absolutely must, otherwise he waits until he can make the search from a computer.

Another finding is that transactional and leisure searches are handled mostly by more experienced users, who tend to have an advanced mobile device and a flat-rate subscription on mobile internet. They do not only use the mobile device for searches while on the go, but also when at home, lying in the sofa or bed, sitting at the kitchen table or while paying a visit to the toilet. For some of these people the mobile has become ubiquitous, providing constant access to mobile internet.

The respondents generally see a great future usefulness in logistical information searches. By using the mobile for such searches on the go, it allows them to plan less in advance. With the wide diffusion of mobiles, people can easily interact with each other on the go adjusting their arrangements in real time. A consequence is that people tend to make more loose arrangements with each other. This freedom increases having by the possibility of searching for shows, films or restaurants when after meeting. In a similar way, the habit of planning beforehand prior to doing routine activities can also be altered. For example, people used to consult timetables for public transport at their PC before their departure at home or at the office. Some people stress that it works perfectly well to continue to do so, and will only use the mobile when there are no other means to gain the information. Others argue that the mobile is a very convenient way to access information on the go, strongly advocating such usage.

How people evaluate their mobile search experience varied notably amongst participants. Some people lacked any experience at all of doing mobile search. Others tried mobile search a couple of times, but that their experience was unsatisfactory and that they therefore did not continue to use such functionality. For example,Lisa (F,26) once used mobile search to know the final score of a football match while at a summer party in a cottage. Since it took her the ´eternity´of fifteen minutes to retrieve the information, she felt discouraged to try it again.

Among people who use newer and more advanced mobile devices, such as touch screen devices, some consider the mobile as a very good means to search and to find relevant information, while others think their experience of using the mobile for search does not yet meet their expectations. A recurring pattern is that respondents often refer and compare their experiences of web searches via mobiles with their computers.

Some respondents are critical with their mobile search experiences. Johan (M,33) finds it difficult to navigate and find information on the mobile. He complains that his mobile only shows the top five results, and that he normally does not click to see the next page of results as it takes too much time. Sara (F,18) says the search process with the mobile involves too many steps, and that the usability level therefore is low. Lennart (M,34) complains that he often must make modifications of the search queries, which takes him unreasonably long time with the mobile user interface, particularly when using a somewhat older mobile device. Stefan (M,23) shows little patience when conducting searches with the mobile, sometimes getting stressed when the requested information is difficult to find. Fredrik (M,18) finds it troublesome to enter Google search queries with his mobile, mostly because the search field is too small. He also argues that the user interface has not been well adapted from the computer to the mobile, and that he wishes that excessive information could be deleted to enable an improved overview. In this sense, Sofia (F,26) appreciates websites that have been specifically adjusted to the mobile, such as the mobile website of the public transport company in the Gothenburg region, a simple but clean text based website containing two fields; "from" and "to". The user can easily insert their query and search for upcoming departures for the public transport system. While some users wish for more mobile specific search engine interfaces, others prefer to view on the mobile the same web sites as on their PC. Common to these users is that they possess and use a touch-screen mobile device, have a flat-rate subscription plan, and prefer to access all the information they normally access with their computer also with their mobile. Both Lina (F,23) and Stefan (M,23) for example, have tried a number of mobile search engines but are most satisfied when they use mobile search from traditional search websites.